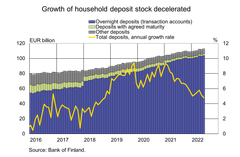

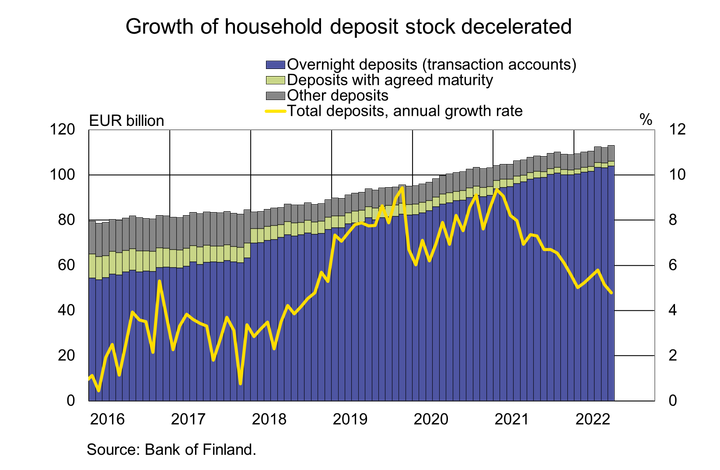

Growth of household deposit stock decelerated

10.8.2022 10:00:00 EEST | Suomen Pankki | Press release

The stock of Finnish households’ deposits[1] exceeded EUR 113 billion in June 2022, a good EUR 5 billion more than a year earlier. In June 2022, the deposit stock grew by almost EUR 900 million. However, the annual rate of growth of the deposit stock has slowed down significantly. In June 2022, the growth rate was 4.8%, as opposed to over 7% in the same period a year earlier. The growth rate has not been slower since September 2018. 92% of households’ assets on deposit accounts was held on transaction accounts[2]. In June, the average interest on transaction accounts was almost zero (0.02%).

Households’ equity and fund share holdings continued to decrease in June

The value of listed shares held by households has declined by almost EUR 12 billion since the end of 2021. During the same period, households have invested a further EUR 1.2 billion in net terms in shares. In June 2022, the value of listed shares held by households stood at EUR 44.6 billion. The value of the shareholdings peaked (at EUR 56.1 billion) in August 2021.

Households’ fund share holdings have declined by EUR 4.5 billion from their peak at end-2021. These holdings have decreased primarily due to the depreciation of equity funds, but the value of bond funds has also declined significantly. Furthermore, households’ redemptions from investment funds outweighed new subscriptions in January–June 2022.[3] At the end of June 2022, the value of investment fund shares held by Finnish households stood at EUR 29.8 billion. Households’ fund investments were mainly (39%) in equity funds.

For more information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: shttps://www.suomenpankki.fi/en/Statistics/saving-and-investing/.

The next news release on saving and investing will be published at 10 am on 9 November 2022.

[1] Stock of deposits at credit institutions operating in Finland.

[2] Transaction accounts refer to overnight deposits repayable on demand. In addition to daily banking accounts, they include other household accounts which do not have withdrawal restrictions but only enable cash withdrawals or which can only be used via another account.

[3] In January–June 2022, households redeemed a total of EUR 270 million of fund shares in net terms.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Internationella valutafonden ger ut en landrapport om Finlands ekonomi19.1.2026 10:10:00 EET | Nyheter

Internationella valutafonden (IMF) har slutfört sin årliga utvärdering av det ekonomiska läget och de ekonomiska utsikterna för Finland. Utvärderingen grundar sig på diskussioner som IMF:s delegation i oktober-november 2025 förde i Finland med myndigheter, forskningsinstitut, privata finansinstitut, arbetsmarknadsparter och andra instanser. Den nu utgivna rapporten representerar IMF:s experters bedömningar och åsikter och den godkändes av IMF:s direktion den 9 januari 2026.

Kansainvälinen valuuttarahasto julkaisee maaraportin Suomen taloudesta19.1.2026 10:10:00 EET | Uutinen

Kansainvälinen valuuttarahasto (IMF) on saanut päätökseen vuosittaisen arvionsa Suomen talouden tilasta ja näkymistä. Arvio perustuu keskusteluihin, joita Suomessa loka-marraskuussa 2025 vieraillut IMF:n asiantuntijaryhmä kävi viranomaisten, tutkimuslaitosten, yksityisten rahoituslaitosten, työmarkkinaosapuolten ja muiden tahojen kanssa. Nyt julkaistu raportti edustaa IMF:n asiantuntijoiden arvioita ja näkemyksiä, ja se hyväksyttiin IMF:n johtokunnassa 9.1.2026.

Finlands Bank har ställt upp nya klimatetappmål för investeringsverksamheten och uppdaterat sina principer för ansvarsfulla investeringar16.1.2026 10:00:00 EET | Nyheter

Finlands Banks direktion har fattat beslut om nya klimatetappmål som styr bankens investeringsverksamhet mot nettonollutsläpp senast 2050. De uppdaterade målen ligger i linje med tidigare uppnådda etappmål, som var vägledande för verksamheten fram till 2025.

Suomen Pankki asetti sijoitustoiminnalle uudet ilmastovälitavoitteet ja päivitti vastuullisen sijoittamisen periaatteet16.1.2026 10:00:00 EET | Uutinen

Suomen Pankin johtokunta on päättänyt uusista ilmastovälitavoitteista, jotka ohjaavat pankin sijoitustoimintaa kohti hiilineutraalisuutta viimeistään vuoteen 2050 mennessä. Päivitys jatkaa aiempien välitavoitteiden linjaa, jotka saavutettuina ohjasivat toimintaa vuoden 2025 loppuun saakka.

Bank of Finland sets new interim climate targets for its investment activities and updates its responsible investment principles16.1.2026 10:00:00 EET | News

The Bank of Finland Board has adopted new interim climate targets to guide its investment activities towards carbon neutrality by 2050 at the latest. This update continues the approach of the previous interim targets, which guided activities up to the close of 2025 and which have been attained.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom