Housing loan market remained brisk in November 2021

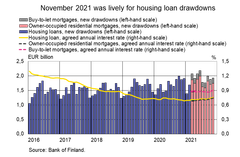

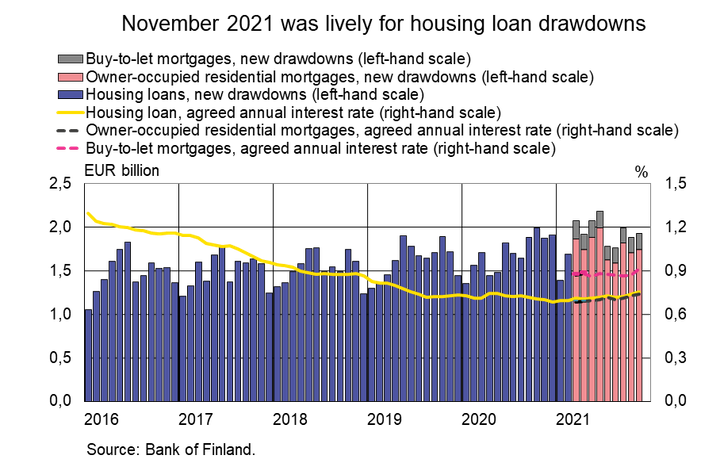

Finnish households’ drawdowns of new housing loans in November 2021 amounted to EUR 1.9 bn, an increase of 3.1% on the same month last year. Buy-to-let mortgages accounted for EUR 180 million of the new housing loans. In the first 11 months of 2021, drawdowns of housing loans have increased by 12% in comparison to the same period in 2020. Due to the high level of drawdowns, the annual growth rate of the housing loan stock remained high (4.2%) at the end of November 2021. However, the growth rate has slowed slightly since July 2021. At the end of November 2021, the stock of housing loans to Finnish households amounted to EUR 106.7 bn, of which buy-to-let mortgages accounted for EUR 8.6 bn.

The average interest rate on new housing loans was 0.76% in November 2021. The average interest rate has remained almost unchanged for several years, but has seen a slight increase in the last few months. It has not been above its current level since May 2019. The average interest rate rose on both owner-occupied residential mortgages and buy-to-let mortgages. In November 2021, the average interest rate on new owner-occupied residential mortgages was 0.74% while the average rate on new buy-to-let mortgages was higher, 0.91%.

During the pandemic, many households have invested in housing, which has been reflected in increased drawdowns of housing loans and holiday residence loans. At the same time, the share of loans with longer repayment periods have increased. Loans with a repayment period of over 25 years accounted for 40.3% of the new housing loans. Their share has increased by 10 percentage points after February 2020, since the onset of the pandemic. The average repayment period was 21 years and 3 months in November 2021. The average repayment period of buy-to-let mortgages (18 years and 2 months) was noticeably shorter than that of owner-occupied residential mortgages (21 years and 3 months).

Loans

Out of all loans to Finnish households at end-November, consumer credit totalled EUR 16.7 bn and other loans EUR 18.0 bn.

Drawdowns of new loans[1] by Finnish non-financial corporations in November amounted to EUR 1.9 bn, of which loans to housing corporations accounted for EUR 505 million. The average interest rate on the new drawdowns declined from October, to 1.5%. The stock of loans to Finnish non-financial corporations at end-November stood at EUR 97.0 bn, of which loans to housing corporations accounted for EUR 39.4 bn.

Deposits

The stock of Finnish households’ deposits at end-November 2021 stood at EUR 109.1 bn, and the average interest rate on the deposits was 0.03%. Overnight deposits accounted for EUR 100.1 bn and deposits with agreed maturity for EUR 2.2 bn of the deposit stock. In November, Finnish households concluded EUR 51 million of new agreements on deposits with agreed maturity, at an average interest rate of 0.18%.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 31 January 2022.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Excl. overdrafts and credit card credit.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Aleksi Grym blir avdelningschef för Finlands Banks betalningssystemsavdelning16.12.2025 16:42:15 EET | Pressmeddelande

Pol.lic., ekon. mag. Aleksi Grym har utnämnts till avdelningschef för Finlands Banks betalningssystemsavdelning från och med den 1 mars 2026. Utnämningen gäller för en period på fem år.

Aleksi Grym maksujärjestelmät-osaston osastopäälliköksi16.12.2025 16:42:15 EET | Tiedote

Suomen Pankin maksujärjestelmät-osaston osastopäälliköksi on nimitetty VTL, KTM Aleksi Grym. Nimitys on tehty viiden vuoden määräajaksi 1.3.2026 alkaen.

Aleksi Grym appointed Head of Payment Systems Department16.12.2025 16:42:15 EET | Press release

Aleksi Grym, Lic.Soc.Sc, MSc (Econ. & Bus. Adm.), has been appointed Head of Department at the Bank of Finland’s Payment Systems Department. The appointment is for a five-year term effective from 1 March 2026.

Fler kortbetalningar till försäljare inom kultur och fritid i juli–september 2025 än tidigare16.12.2025 10:00:00 EET | Pressmeddelande

Fler kortbetalningar i juli–september 2025 än tidigare. Ökningen förklaras sektorspecifikt huvudsakligen av tre sektorer: kultur och fritid, livsmedel samt konsumtion av andra varor och tjänster. För två sektorer minskade kortbetalningarnas totalsumma i juli–september 2025.

Korteilla maksettiin heinä-syyskuussa 2025 aiempaa enemmän kulttuuri- ja vapaa-ajan myyjille16.12.2025 10:00:00 EET | Tiedote

Korteilla maksettiin heinä-syyskuussa 2025 aiempaa enemmän. Toimialakohtaisesti kasvu selittyy pääasiassa kolmella toimialalla: kulttuurilla ja vapaa-ajalla, elintarvikkeilla sekä muilla tavaroilla ja palveluilla. Kahdella toimialalla korttimaksujen kokonaissumma vähentyi heinä-syyskuussa 2025.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom