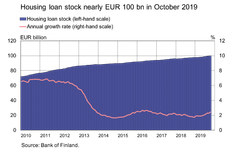

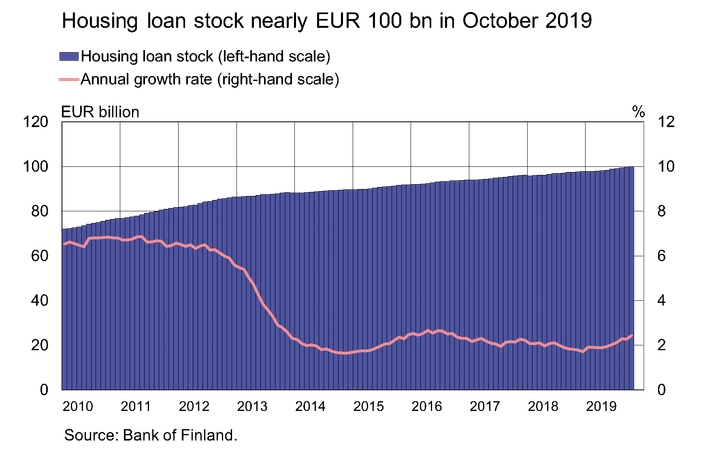

Housing loan stock nearly EUR 100 bn

2.12.2019 13:00:00 EET | Suomen Pankki | Press release

New housing loan drawdowns in October 2019 amounted to EUR 1.9 bn, up by EUR 145 million on the corresponding period a year earlier. The last time housing loan drawdowns in October have exceeded this level was in 2007. The decline in the average interest rate on new housing loans has halted since the summer, and during the past three months the average rate has been 0.72%.

Recent years have seen a lengthening in the average amortisation periods of housing loans in Finland. In October 2019, the average maturity of a housing loan was 20 years 9 months. Over 68% of new housing loans were granted with a maturity of over 20 years. The share of loans with longer amortisation periods (over 29 years) in new housing loans has increased: in October 2019, the share was 7%, compared with 3% in October 2018.

Loans

At the end of October, household credit comprised EUR 16.5 bn in consumer credit and EUR 17.6 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2.2 bn in October. The average interest rate on new corporate-loan drawdowns declined from September, to 2.21%. At the end of October, the stock of euro-denominated loans to non-financial corporations was EUR 90.6 bn, of which loans to housing corporations accounted for EUR 34.6 bn.

Deposits

The stock of deposits by Finnish households at end-October totalled EUR 94.4 bn and the average interest rate on the deposits was 0.11%. Overnight deposits accounted for EUR 81.5 bn and deposits with agreed maturity for EUR 4.9 bn of the deposit stock. In October, households concluded EUR 0.4 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.12%.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

Contacts

Meri Sintonen, tel. +358 9 183 2247, email: meri.sintonen(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Räntan på centralbanksinlåningen tyngde Finlands Banks verksamhetsresultat också 202513.3.2026 11:00:00 EET | Pressmeddelande

Bankfullmäktige har i dag fastställt Finlands Banks bokslut på framställning av Finlands Banks direktion. Finlands Banks reviderade resultat för räkenskapsåret 2025 är liksom föregående år noll euro efter upplösning av avsättningar. Verksamhetsresultatet för 2025 var −215 miljoner euro (−1 027 miljoner euro 2024) och det täcktes genom upplösning av den generella avsättningen.

Keskuspankkitalletuksille maksetut korot painoivat Suomen Pankin toiminnallista tulosta myös vuonna 202513.3.2026 11:00:00 EET | Tiedote

Pankkivaltuusto on tänään vahvistanut Suomen Pankin tilinpäätöksen Suomen Pankin johtokunnan esityksestä. Suomen Pankin tilintarkastettu tulos tilikaudelta 2025 on varausten purkamisen jälkeen nolla euroa edellisvuoden tavoin. Vuoden 2025 toiminnallinen tulos oli –215 milj. euroa (–1 027 milj. euroa vuonna 2024), ja se katettiin purkamalla reaaliarvovarausta.

Bank of Finland’s operating profit for 2025 again weakened by interest paid on central bank deposits13.3.2026 11:00:00 EET | Press release

The Parliamentary Supervisory Council has today, upon proposal by the Bank of Finland Board, confirmed the Bank of Finland’s financial statements. The Bank of Finland’s audited profit for the financial year 2025, after reductions in provisions, totals EUR 0.00, as it did the previous year. The Bank’s operating loss for 2025 was EUR -215 million (2024: EUR -1,027 million), which was covered by making a reduction in the provision against real value loss.

Kontaktlös betalning blev vanligare i oktober–december 2025 jämfört med motsvarande tidpunkt året innan5.3.2026 10:00:00 EET | Pressmeddelande

Med kort betalades i oktober–december mer än under motsvarande period året innan. Framför allt gjordes under det sista kvartalet fler kontaktlösa betalningar än under motsvarande period 2024.

Lähimaksaminen oli yleisempää loka-joulukuussa 2025 kuin vastaavana ajankohtana edellisvuonna5.3.2026 10:00:00 EET | Tiedote

Korteilla maksettiin loka-joulukuussa enemmän kuin viime vuonna vastaavana ajanjaksona. Erityisesti lähimaksuja tehtiin vuoden viimeisellä neljänneksellä enemmän kuin vuonna 2024 samalla ajanjaksolla.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom