Ilmarinen’s Interim Report 1 January to 31 March 2023: Positive return on investments, premiums written grew and cost-effectiveness improved

- Thanks to the good performance of investment activities, the total result for January–March grew to EUR 0.4 (-1.3) billion.

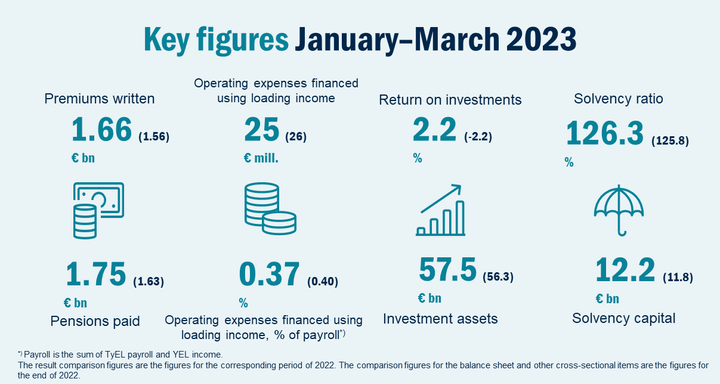

- Premiums written grew by 7 per cent to EUR 1.66 (1.56) billion. EUR 1.75 (1.63) billion was paid in pensions.

- Net customer acquisition was EUR 70 (55) million and rolling customer retention for the previous 12 months was 97.1 (97.2) per cent.

- Operating expenses financed using loading income decreased by three per cent to EUR 25 (26) million and were 0.37 (0.40) per cent of the TyEL payroll and YEL income of the insured.

- Solvency capital increased to EUR 12.2 (11.8) billion and the solvency ratio to 126.3 (125.8) per cent.

- Outlook: Ilmarinen’s premiums written are expected to grow on the back of payroll growth, but the growth pace is expected to slow down from the previous year.

The interim report result comparison figures are the figures for the corresponding period of 2022. Unless otherwise indicated, the comparison figures for the balance sheet and other cross-sectional items are the figures for the end of 2022.

President and CEO Jouko Pölönen’s review

“Last year, Ilmarinen became the most cost-effective earnings-related pension company and saw its efficiency improve further as expenses decreased and premiums written increased. Despite increasing uncertainty in the investment markets, the return on investments in the early part of the year rose to 2.2 per cent and solvency strengthened.

The year started on a positive note in the investment markets, with stock prices rising and interest rates falling. The collapse of Silicon Valley Bank and the takeover of Credit Suisse by UBS led to a lack of confidence in the banking sector, unnerving the financial markets and dimming the economic outlook. The transition from keeping the threat of deflation at bay to tackling high inflation has proved to be challenging for central banks, and it is expected to take quite some time to bring inflation back to the price stability target.

Central banks have continued to hike policy rates in an effort to lower the persistently high inflation rate, which is slowing economic growth. The rapid rise in interest rates and tightening of financing conditions are causing challenges and increasing financial costs for indebted governments, companies and households. The rising interest rate level affects the valuations of all asset classes and has a particular impact on the highly leveraged real estate sector.

Ilmarinen’s return on investments in January–March was +2.2 per cent thanks to the positive return on equities and shares in the early part of the year. The long-term average nominal return on investments was 5.8 per cent, corresponding to a 3.8 per cent average annual real return since 1997. The solvency ratio rose to 126.3 per cent and solvency capital to EUR 12.2 billion. The solvency buffers built up through long-term funding and investing protect pension assets against market volatility.

Premiums written grew by 7 per cent to EUR 1,660 million following the increase in the payroll for employees insured with Ilmarinen. The number of employees in the companies belonging to Ilmarinen’s business cycle index increased by 2.1 per cent year-on-year during January–March. We paid EUR 1,754 million in pensions to around 456,000 pensioners. The average pension in 2022 rose to EUR 1,845 and an index increase of 6.8 per cent was made to pensions at the turn of the year.

The cost-effectiveness of Ilmarinen’s operations has improved significantly, and last year Ilmarinen became the most cost-effective company in the industry, measured by the ratio of operating expenses to expense loading components. In January–March, the operating expenses financed using loading income decreased by 3 per cent to EUR 25 million and were 0.37 per cent of the payroll. Earnings-related pension companies started applying company-specific expense loading rates as of the beginning of the year. Following this change, our customers will see the benefits of improved cost-effectiveness directly in their insurance contributions.

The Finnish economy is expected to decline this year, and the long-term outlook gives rise to concern. The indebtedness of the government has increased strongly in recent years, and rising interest rate expenses are adding to the financial challenges. At the same time, the working-age population is shrinking and the number of pensioners is growing. The birth rate has been decreasing for a long time, and Finland registered the lowest number of births in 150 years last year. Financing the services of a welfare state will be a huge challenge for future governments, and one that will require measures to support not only the economy and employment but also the birth rate and labour immigration. These measures and, more specifically, the long-term real returns on pension assets, will play a major role also in the financing of the pension system. The solvency framework for earnings-related companies must be reshaped so as to enable them to seek better long-term returns.”

Read more:

Contacts

Jouko Pölönen, President and CEO, tel. +358 50 1282

Mikko Mursula, Chief Investment Officer, tel. +358 50 380 3016

Annukka Lalu, acting Executive Vice President, Communications and Corporate Responsibility, tel. +358 50 563 4211

Images

About Ilmarinen

Ilmarinen’s task is to ensure that our customers receive the pension they earned from employment. We promote a better working life and thus help our customers succeed. In total, we are responsible for the pension cover of some 1,1 million people. We have investment assets of over EUR 57 billion to cover pension liabilities. For more information, please visit: www.ilmarinen.fi.

Subscribe to releases from Ilmarinen

Subscribe to all the latest releases from Ilmarinen by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Ilmarinen

Ilmarisen toimitusjohtajaksi Mikko Mursula23.6.2025 12:30:26 EEST | Tiedote

Ilmarisen hallitus on nimittänyt Ilmarisen uudeksi toimitusjohtajaksi KTM Mikko Mursulan. Mursula on toiminut aiemmin Ilmarisen sijoitusjohtajana ja toimitusjohtajan sijaisena.

Ilmarisen suhdanneindeksi: Työntekijämäärän lasku jatkuu edelleen, näkymä on heikko16.6.2025 10:15:03 EEST | Tiedote

Työntekijämäärä väheni toukokuussa Ilmarisen suhdanneindeksiin kuuluvissa yrityksissä -2,0 prosenttia verrattuna edelliseen vuoteen. Seuratuista toimialoista eniten laskivat henkilöstövuokraus, terveys- ja sosiaalipalvelut sekä majoitus- ja ravitsemisala. Maantieteellisesti tarkasteltuna työntekijämäärät laskivat kaikilla alueilla Suomessa.

Tutkimus: Kuormitus ei pudota nuoria työelämästä – ongelmana työhön kiinnittyminen11.6.2025 09:04:36 EEST | Tiedote

Huolen aihe ei ole niinkään se, että nuorten hyvin alkaneet työurat katkeaisivat liialliseen kuormitukseen. Sen sijaan työkyvyttömyyseläkettä hakevat nuoret, jotka eivät ole vielä työelämään päässeetkään. Työkyvyn ja motivaation osalta nuoret ovat varsin kahtiajakautunut ikäryhmä. Tiedot selviävät Ilmarisen juuri julkaistusta tutkimuksesta.

Tutkimus: Yhä harvempi eläkeläinen haluaisi tehdä töitä4.6.2025 10:41:21 EEST | Tiedote

Aiempaa harvempi eläkeläinen haluaisi tehdä töitä. Eläkesuunnitelmista tulisi keskustella työpaikoilla nykyistä avoimemmin ja aikaisemmin. Näin myös heille, jotka yhä haluaisivat työskennellä osittain, voitaisiin luoda mahdollisuuksia jatkaa töissä. Tiedot selviävät Ilmarisen kyselytutkimuksesta.

Kutsu kesätoimittajille: Saanko koskaan eläkettä? – tervetuloa Ilmarisen aamiaistilaisuuteen 6.6.20253.6.2025 09:03:49 EEST | Tiedote

Karkaako eläkeikä, saanko koskaan eläkettä? Miksi mielenterveyssyyt vievät yhä nuorempia pois työelämästä? Kesätoimittaja, tule tapamaan Ilmarisen väkeä ja päivitä tietosi eläkkeistä, työkyvystä sekä työurista perjantaina 6.6.2025. Luvassa on myös ideoita juttuaiheiksi. Vielä ehdit ilmoittautua !

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom