Market value of Finnish shares and shareholdings soared

11.5.2021 10:00:00 EEST | Suomen Pankki | Press release

The market value of shares issued by listed Finnish companies[1] has increased for several consecutive years. It declined temporarily because of the COVID-19 crisis, but since March 2020, the market capitalisation of Finnish equities has risen by 48% to stand at EUR 307 billion at the end of March 2021. Half of Finnish companies’ listed shares are held by domestic owners.[2] In addition to appreciation, the total value of equities was boosted somewhat by several initial public offerings by Finnish companies in early 2021. In January-March, Finnish companies issued new equities worth EUR 360 million.[3]

Listed shares constitute a significant proportion of Finns’ financial assets. At the end of March 2021, Finns’[4] equity holdings totalled EUR 236.2 billion, 35% of which in foreign equities. In March 2021, the market value of the holdings increased by EUR 7.3 billion. Meanwhile, Finns made net equity investments of EUR 790 million, EUR 600 million of which was allocated to foreign equities.

Finnish households’ holdings in listed shares reached a record high (EUR 48.9 billion) in March. The value of households’ equity holdings increased by EUR 1.6 billion, while households made EUR 290 million of new net equity investments in March 2021. 90% of equities held by households were in Finnish companies. Households are the largest domestic owner sector in Finnish equities. In addition to direct equity holdings, households have indirect holdings through investment funds and unit-linked insurance policies made with insurance companies.

Equity funds surpassed bond funds as the largest fund type in Finland

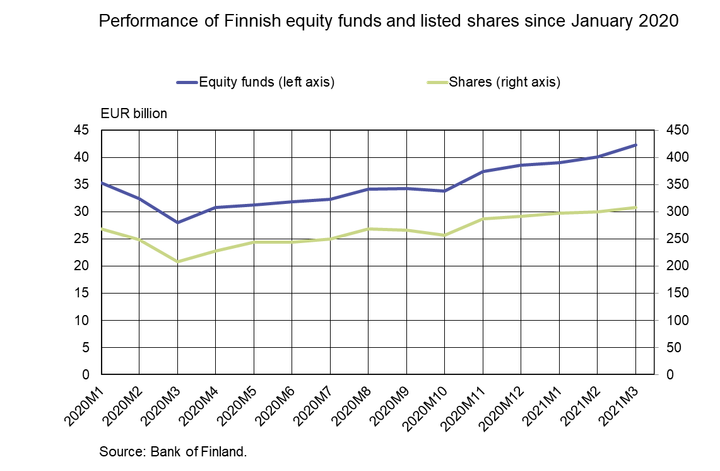

The price performance of the equity markets has driven the rise of Finnish investment funds’ fund share liability into a record-high level. At the end of March 2021, the fund share liability stood at EUR 143.6 billion. The growth was particularly strong in equity funds, which surpassed bond funds as Finland’s largest investment fund type in March 2021.

The fund share liability of Finnish equity funds totalled EUR 60.7 billion at the end of March 2021. It had grown by EUR 6.2 billion in the first quarter of 2021. The appreciation of the underlying investments boosted the fund share liability by EUR 5.1 billion, in addition to which there were EUR 1.1 billion of net subscriptions in equity funds.

Finnish equity funds’ investments in foreign shares experienced a particularly strong appreciation (EUR 3.7 billion) in early 2021. At the end of March 2021, Finnish equity funds had a total of EUR 43.6 billion of foreign shareholdings and EUR 7.8 billion of domestic shareholdings. The funds invested a further EUR 1.5 billion in foreign equities while reducing EUR 0.1 billion from their domestic equity holdings during the first quarter of 2021.

At the end of March 2021, Finnish households held in Finnish investment funds’ units worth EUR 11.5 billion. If households’ indirect holdings through unit-linked insurance policies are included, households are the largest group of unitholders in Finnish equity funds. The appreciation of equity funds increased the value of households’ holdings by EUR 0.9 billion in January–March. In addition, households made net subscriptions of EUR 0.3 billion in equity funds in January–March 2021.

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing.

The next news release on saving and investing will be published on 10 August 2021.

[1] Incl. both non-financial corporations (S.11) and financial corporations (S.12).

[2] Source: Bank of Finland's securities statistics.

[3] The IPOs were concentrated on March in particular.

[4] Holdings of investment funds, households and employment pension schemes accounted for 60% of Finns’ total equity holdings.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kontaktlös betalning blev vanligare i oktober–december 2025 jämfört med motsvarande tidpunkt året innan5.3.2026 10:00:00 EET | Pressmeddelande

Med kort betalades i oktober–december mer än under motsvarande period året innan. Framför allt gjordes under det sista kvartalet fler kontaktlösa betalningar än under motsvarande period 2024.

Lähimaksaminen oli yleisempää loka-joulukuussa 2025 kuin vastaavana ajankohtana edellisvuonna5.3.2026 10:00:00 EET | Tiedote

Korteilla maksettiin loka-joulukuussa enemmän kuin viime vuonna vastaavana ajanjaksona. Erityisesti lähimaksuja tehtiin vuoden viimeisellä neljänneksellä enemmän kuin vuonna 2024 samalla ajanjaksolla.

Contactless payments increased in October–December 2025 from a year earlier5.3.2026 10:00:00 EET | Press release

Cards payments in October–December grew year-on-year. In particular, more contactless payments were made in the fourth quarter than in same period in 2024.

Hushållens utestående konsumtionskrediter över 28 miljarder euro4.3.2026 10:00:00 EET | Pressmeddelande

Hushållens totala utestående konsumtionskrediter uppgick vid utgången av 2025 till 28,2 miljarder euro och årsökningen har mattats av till 0,1 %. Av hushållens totala utestående konsumtionskrediter bestod ungefär hälften av konsumtionskrediter utan säkerhet (exkl. fordonslån) och deras årsökning var 1,5 %.

Kotitalouksien kulutusluottokanta yli 28 mrd. euroa4.3.2026 10:00:00 EET | Tiedote

Kotitalouksien kokonaiskulutusluottokanta oli vuoden 2025 lopussa 28,2 mrd. euroa ja sen vuosikasvuvauhti oli hidastunut 0,1 prosenttiin. Kotitalouksien kokonaiskulutusluottokannasta noin puolet oli vakuudettomia kulutusluottoja (pl. ajoneuvolainat), ja niiden vuosikasvuvauhti oli 1,5 %.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom