Peer-to-peer loans and loan-based crowdfunding decreased in 2020

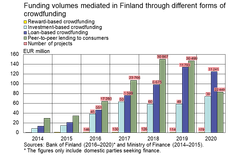

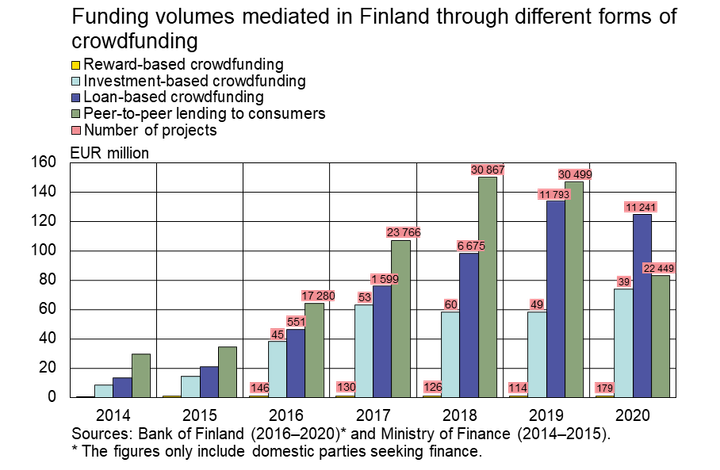

The volume of funding mediated in Finland through crowdfunding and peer-to-peer lending markets declined in 2020. Funding mediated to Finnish applicants decreased 17% from the previous year due to a reduction in P2P lending and loan-based crowdfunding. In 2020, the total volume of funding mediated through P2P lending and crowdfunding markets amounted to EUR 282 million.

Coronavirus pandemic reduced P2P lending in Finland

The Finnish peer-to-peer lending market contracted in 2020. The coronavirus pandemic and the consequent lower interest rate cap tightened the operating conditions for the P2P lending market. The number of active P2P loan companies in Finland decreased as companies reformed their business[1] or discontinued it altogether. The volume and number of P2P loans mediated to consumer through service platforms in 2020 decreased significantly from the previous years.

In 2020, the volume of P2P loans mediated amounted to EUR 86 million, which is 46% less than in 2019. P2P loans to Finnish consumers accounted for EUR 83 million and those to foreign consumers for EUR 3 million. P2P loans mediated to foreign consumers decreased significantly from EUR 14 million in 2019.

In 2020, the number of P2P loans mediated was 18% lower than in 2019. Approximately 22,000 P2P loans were mediated to Finnish consumers in 2020. Finnish P2P loan platforms were used to mediate some 2,300 P2P loans to foreign consumers, which was almost 5,000 fewer than in 2019.

Record volume of investment-based crowdfunding mediated

In 2020, the volume of crowdfunding mediated on Finnish service platforms was 4.6% higher than in 2019. Finnish companies raised funding worth EUR 199 million through crowdfunding platforms[2] in 2020. 62% of the crowdfunding raised by companies was loan-based and 37% investment-based. The share of reward-based crowdfunding was minor.

Although crowdfunding received by companies has increased in recent years, it’s role in funding raised by Finnish companies remains small. In 2020, the volume of crowdfunding received by Finnish companies was only 1% of corporate loans drawn down from credit institutions.

Crowdfunding mediated to Finnish companies grew particularly on the back of investment-based funding[3]. In 2020, Finnish companies raised a total of EUR 74 million of investment based crowdfunding, 27% more than in 2019.[4] Investment-based crowdfunding raised by Finnish companies reached a record level in 2020.

The number of investment-based crowdfunding rounds carried out on crowdfunding platforms decreased in 2020. The number of successful investment-based crowdfunding rounds was 39, which is 10 fewer than in 2019. The average amount raised increased. On average, companies raised EUR 1.9 million through investment-based crowdfunding in 2020, which is EUR 700,000 more than in 2019.

Loan-based crowdfunding mediated to Finnish companies decreased by 7% in 2020 but retained its position as the main source of crowdfunding for companies. Loan-based crowdfunding to companies totalled EUR 124 million in 2020, which is EUR 9 million less than in 2019.

In 2020, Finnish companies carried out fewer loan-based crowdfunding rounds than in 2019. In 2020, the number of successful funding rounds was 11,200, which is 5% fewer than in 2019. The average loan received through a funding round totalled approximately EUR 11,000. The average value of a loan mediated through Finnish crowdfunding platforms has declined ever since 2017.

The volume of reward-based crowdfunding increased[5] somewhat in 2020 but remained low. In 2020, the volume of reward-based crowdfunding mediated in Finland amounted to EUR 1 million, which is 30% more than in 2019. The number of successful funding rounds through reward-based crowdfunding platforms was almost 180 in 2020. The average amount of funding received through these funding rounds decreased to just over EUR 5,700, which is 17% less than the average value of reward-based crowdfunding received last year.

Funding volumes mediated in Finland through different forms of crowdfunding*

|

2018, EUR million |

2019, EUR million (12-month change) |

2020, EUR million (12-month change) |

|

|

Loan-based crowdfunding |

98.3 (29%) |

133.6 (36%) |

124.4 (-7%) |

|

Investment-based crowdfunding |

58.0 (-8%) |

58.3 (1%) |

73.7 (27%) |

|

Reward-based crowdfunding |

0.7 (-27%) |

0.8 (8%) |

1.0 (30%) |

|

Peer-to-peer lending to consumers |

150.1 (40%) |

146.7 (-2%) |

82.8 (-44%) |

|

Total |

307.2 (24%) |

339.4 (11%) |

282.0 (-17%) |

* The figures include domestic parties seeking funding.

For further information, please contact:

Antti Alakiuttu, tel. +358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Miska Jokinen, tel. +358 9 183 2122, email: miska.jokinen(at)bof.fi,

Maija Keskinen, tel. +358 9 183 2004, email: maija.keskinen(at)bof.fi.

[1] For example, companies started granting loans and credit from their own balance sheet. Lending by such companies is covered by the new Bank of Finland data collection and statistics on other financial institutions (OFI).

[2] Investment-, loan- and reward-based crowdfunding

[3] Direct equity investment in a non-listed company through a crowdfunding platform

[4] In investment- and reward-based crowdfunding, the impact of individual large funding rounds is more significant than in debt-based crowdfunding due to the lower number of funding rounds.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Bank of Finland’s interim forecast: Sticky recovery in Finland’s economy16.9.2024 11:01:00 EEST | Press release

According to the Bank of Finland’s interim forecast, published today, the Finnish economy will contract by 0.5% for the full year 2024, and the recovery will be slow. The economy will then grow by 1.1% in 2025. Growth will gather pace somewhat in 2026, rising to 1.8%. In the early part of this year, growth in the Finnish economy was subdued. Private consumption and private investment have been weak, and the fragile economic growth has relied on exports and public demand. The labour market has felt the effects of the sluggish economy, and inflation has slowed considerably. The recovery of the Finnish economy in the immediate years ahead will be underpinned by various factors. Purchasing power will be supported by an improvement in employment, a moderate inflation rate and a rise in earnings. In addition, the export outlook will benefit from a strengthening of the euro area economy. Household and business confidence is expected to be restored gradually, and the financial markets are anti

Finlands Banks interimsprognos: Ekonomin repar sig långsamt16.9.2024 11:01:00 EEST | Tiedote

Enligt Finlands Banks interimsprognos, som publicerats idag, krymper den finländska ekonomin med 0,5 % under 2024 och återhämtningen går långsamt. År 2025 växer ekonomin med 1,1 %. Under 2026 stärks tillväxten något, till 1,8 %. Den ekonomiska tillväxten i Finland har varit dämpad under början av året. Den privata konsumtionen och de privata investeringarna har utvecklats svagt, och den sköra tillväxten har vilat på exporten och den offentliga efterfrågan. Arbetsmarknaden har drabbats av den svaga konjunkturen och inflationen har bromsat in betydligt. Olika faktorer stöder återhämtningen i den finländska ekonomin under de närmaste åren. Stigande sysselsättning, måttlig inflation och ökade inkomster stärker köpkraften. Dessutom förbättras exportutsikterna av den ekonomiska uppgången i euroområdet. Hushållens och företagens förtroende uppskattas sakta återhämta sig och finansmarknaden väntar sig att räntorna gradvis sjunker. Inflation och arbetslöshet Uppgången i konsumentpriserna har ma

Suomen Pankin väliennuste: Talouden toipuminen on tahmeaa16.9.2024 11:01:00 EEST | Tiedote

Suomen Pankin tänään julkaiseman väliennusteen mukaan Suomen talous supistuu 0,5 prosenttia vuonna 2024 ja elpyminen on hidasta. Vuonna 2025 talous kasvaa 1,1 prosenttia. Kasvu voimistuu hieman vuonna 2026, 1,8 prosenttiin. Suomen talous on kasvanut alkuvuonna vaimeasti. Yksityinen kulutus ja yksityiset investoinnit ovat kehittyneet heikosti, ja vienti sekä julkinen kysyntä ovat kannatelleet haurasta kasvua. Työmarkkinat ovat kärsineet heikosta suhdanteesta, ja inflaatio on hidastunut merkittävästi. Eri tekijät tukevat Suomen talouden toipumista lähivuosina. Työllisyyden koheneminen, maltillinen inflaatio ja ansioiden nousu kasvattavat ostovoimaa. Lisäksi vientinäkymiä parantaa euroalueen talouden vahvistuminen. Kotitalouksien ja yritysten luottamuksen arvioidaan elpyvän vähitellen, ja rahoitusmarkkinoilla odotetaan korkojen laskevan asteittain. Inflaatio ja työttömyys Kuluttajahintojen nousu on hidastunut Suomessa laaja-alaisesti vuonna 2024. Suomen Pankin inflaatioennuste kuluvalle v

Eurosystemets penningpolitiska beslut12.9.2024 15:21:00 EEST | Uutinen

ECB:s pressmeddelande 12 september 2024 ECB-rådet beslutade idag att sänka räntan på inlåningsfaciliteten – den ränta med vilken den penningpolitiska inriktningen styrs – med 25 punkter. Baserat på ECB-rådets uppdaterade bedömning av inflationsutsikterna, dynamiken i underliggande inflation och styrkan i den penningpolitiska transmissionen är det nu lämpligt att ta ett nytt steg för att lätta på graden av penningpolitiska restriktioner. Nya inflationsdata har inkommit i stort sett som förväntat och de senaste prognoserna från ECB:s experter bekräftar de tidigare inflationsutsikterna. Inflationen ses nu i genomsnitt ligga på 2,5 % 2024, 2,2 % 2025 och 1,9 % 2026, precis som i prognoserna från juni. Inflationen väntas öka igen under senare delen av detta år, delvis på grund av att kraftiga nedgångar i energipriser väntas försvinna från årstakten. Inflationen bör därefter sjunka mot vårt mål under det andra halvåret nästa år. Vad gäller kärninflationen har prognoserna för 2024 och 2025 re

EKP:n rahapoliittisia päätöksiä12.9.2024 15:21:00 EEST | Uutinen

EKP:n lehdistötiedote 12.9.2024 EKP:n neuvosto päätti tänään laskea talletuskorkoa, jolla se säätelee rahapolitiikan mitoitusta. Korkoa lasketaan 0,25 prosenttiyksikköä. EKP:n neuvosto katsoi inflaationäkymiä koskevan päivitetyn arvionsa, pohjainflaation kehityksen ja rahapolitiikan tehokkaan välittymisen perusteella, että rahapolitiikan rajoittavuutta on nyt aiheellista lieventää entisestään. Viimeisimmät inflaatiotiedot ovat suurin piirtein odotusten mukaiset, ja EKP:n tuoreet asiantuntija-arviot osoittavat inflaationäkymien pysyneen ennallaan. Kuten jo kesäkuun arvioissa, kokonaisinflaation arvioidaan olevan keskimäärin 2,5 % vuonna 2024 ja 2,2 % vuonna 2025 sekä 1,9 % vuonna 2026. Inflaation odotetaan nopeutuvan jälleen vuoden loppupuolella osittain siksi, että energian aiemmat jyrkät hinnanlaskut jäävät pois vuotuisista inflaatioluvuista. Sen jälkeen inflaation odotetaan hidastuvan ja lähestyvän tavoitettaan ensi vuoden jälkipuoliskolla. Energian ja elintarvikkeiden hinnoista puhd

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom