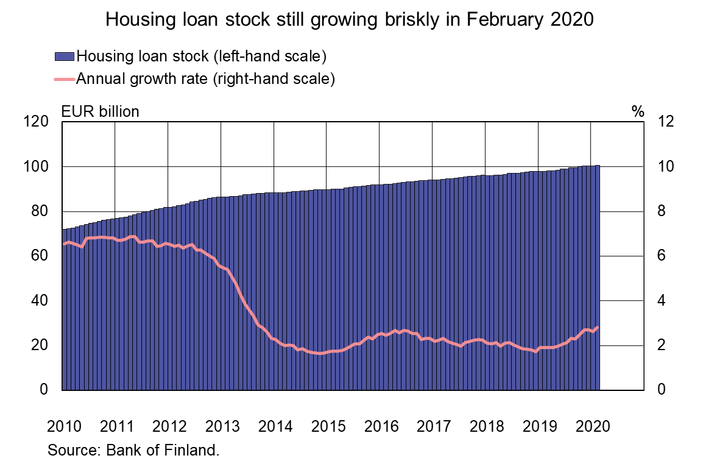

Housing loan stock still growing briskly in February

31.3.2020 13:00:00 EEST | Suomen Pankki | Press release

Households’ drawdowns of new housing loans in February 2020 amounted to EUR 1.6 bn. February is usually a quiet month for new housing-loan drawdowns. This year, however, it was exceptionally lively compared with the same month in the previous years. The average interest rate on new housing-loan drawdowns declined from January, to 0.71%.

The average repayment period of housing loans lengthened slightly in February 2020, reaching 20 years and 8 months. At present, the most typical repayment period for new housing loans in Finland is 24–26 years. These loans account for almost half of all new housing loans. Housing loans with the longest repayment periods – loans exceeding 29 years – are granted less frequently. In February 2020, their share was 7.0%.

On 12 March 2020, the Government announced its recommendations related to the coronavirus pandemic. This was also reflected in consumer behaviour in Finland. Statistics Finland collects data on consumer confidence. According to Statistics Finland, consumer confidence was still unchanged in February 2020, but weakened in March [1]. The balance figure was -4.5 in February, but fell to -7.1 in March. The changes may be reflected in borrowing decisions in the coming months.

Loans

At the end of February 2020, household credit comprised EUR 16.7 bn in consumer credit and EUR 17.7 bn in other loans. Drawdowns of new loans by non-financial corporations (excl. overdrafts and credit card credit) amounted in February to EUR 1.6 bn. The average interest rate on new corporate-loan drawdowns rose from January, to 2.3%. At the end of February, the stock of euro-denominated loans to non-financial corporations totalled EUR 92.4 bn, of which loans to housing corporations accounted for EUR 35.5 bn.

Deposits

At the end of February 2020, the stock of deposits of Finnish households totalled EUR 96.1 bn and the average interest rate on the deposits was 0.10%. Overnight deposits accounted for EUR 83.3 bn and deposits with an agreed maturity for EUR 4.6 bn of the deposit stock. In February, households concluded EUR 0.2 bn of new agreements on deposits with an agreed maturity, at an average interest rate of 0.19%.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Anu Karhu, tel. +358 10 831 2228, email: anu.karhu(at)bof.fi.

The next news release will be published at 1 pm on 4 May 2020.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Statistics Finland’s data collection for March covered the period 2 March 2020–19 March 2020.Keywords

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Hushållens aktieinvesteringar avkastade mycket bra 20259.2.2026 10:00:00 EET | Pressmeddelande

Hushållens aktieinvesteringar avkastade under året starkt i och med värdeökningen på inhemska aktier och vid årets slut var investeringarnas värde det högsta genom tiderna. Också hushållens fondinvesteringar var vid årets slut större än någonsin.

Kotitalouksien osakesijoitukset tuottivat erittäin hyvin vuonna 20259.2.2026 10:00:00 EET | Tiedote

Kotitalouksien osakesijoitukset tuottivat vuoden aikana vahvasti kotimaisten osakkeiden arvonnousun myötä, ja sijoitusten arvo oli vuoden lopussa kaikkien aikojen suurin. Myös kotitalouksien rahastosijoitukset olivat vuoden lopussa kaikkien aikojen suurimmat.

Household equity investments performed exceptionally well in 20259.2.2026 10:00:00 EET | Press release

Households’ equity investments performed strongly during the year, driven by the appreciation of domestic shares, and the value of investments reached an all-time high at the end of the year. Households’ mutual fund investments also closed the year at an all-time high.

Eurosystemets penningpolitiska beslut5.2.2026 15:23:03 EET | Pressmeddelande

ECB-rådet beslutar om penningpolitiken i euroområdet. ECB-rådet beslutade idag att hålla de tre styrräntorna oförändrade.

EKP:n rahapoliittisia päätöksiä5.2.2026 15:23:03 EET | Tiedote

EKP:n neuvosto päättää euroalueen rahapolitiikasta.8 EKP:n neuvosto päätti tänään pitää EKP:n kolme ohjauskorkoa ennallaan.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom