Mastercard and Doconomy launch the future of sustainable payments

Doconomy and Mastercard announce their joint effort to combat climate change by enabling DO – a free and easy-to-use mobile banking service that lets users track, understand and reduce their CO2 footprints through carbon offsetting. The launch of DO sets a new standard for purpose-driven payment services and is a major step in Mastercard’s commitment to drive innovation for a sustainable future.

By implementing DO, Mastercard and Doconomy let users’ values guide their everyday consumption towards more sustainable choices. DO also enables carbon offsetting via UN certified projects. As part of the service DO offers a possibility to invest in funds with a positive impact on people and the planet. This way the solution gives the consumer insights into the environmental effects of their consumptions, paired with tools for creating change by making sustainable choices.

“Together with Doconomy we can engage consumers, retailers and businesses in the fight against climate change. This collaboration is an important part of our focus on sustainability, and for the first time offers consumers a simple solution to take control and responsibility of their carbon footprint, generated from what they consume,” says Mark Barnett, Divisional President of Mastercard UK, Ireland, Nordic and Baltics.

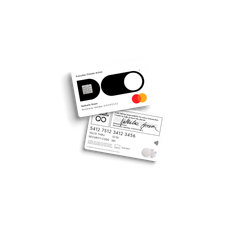

In addition to offering users to make their consumption more sustainable, customers can also apply for the physical, climate-friendly and biodegradable DO Mastercard payment card. The card, which is printed with recycled pollution (Air-Ink) and with no magnetic strip is the first of its kind in the world. The DO card is the most tangible payment service effort on the global SDG 12 scene.

”Via Mastercard’s global network Doconomy can reach and leverage the power of consumers all over the world and direct capital towards sustainable initiatives. For us, there is no partner better suited than Mastercard, given their sense of purpose and leading technical expertise,” says Nathalie Green, CEO at Doconomy.

DO has attracted attention from some of the world’s most prominent actors. The United Nation’s UNFCCC-secretariat wants to explore a collaboration with Doconomy and Mastercard to promote climate action and awareness among citizens and organizations globally.

“DO represents a new and interesting way of bringing climate action directly to the consumer, which is one of our strategic objectives in our work on Global Climate Action,” says Niclas Svenningsen, Manager, Global Climate Action at UNFCCC.

The DO app will be available during April. To join the movement and read more about how we fight climate change through consumption you can visit: https://doconomy.com.

Avainsanat

Yhteyshenkilöt

For more information, please contact:

Annika Kristersson

Director Communications, Nordic and Baltics, Mastercard

mobile +46 703 173 545

Annika.Kristersson@mastercard.com

Kuvat

Tietoja julkaisijasta

About Doconomy

Doconomy AB was founded in 2018 and is both a fintech startup as well as a philosophy about how we as humans can use our money as a tool for positive change for the climate. Doconomy's vision is to enable a sustainable lifestyle for everyone by providing simple mobile banking services that can change behavior, manage savings and reward a development towards sustainable consumption. Doconomy uses the Åland Index developed by Ålandsbanken to track the impact of every transaction. Follow us on Twitter @doconomy

About Mastercard

Mastercard (NYSE: MA), www.mastercard.com, is a technology company in the global payments industry. Our global payments processing network connects consumers, financial institutions, merchants, governments and businesses in more than 210 countries and territories. Mastercard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – easier, more secure and more efficient for everyone. Follow us on Twitter @MastercardNews, join the discussion on the Beyond the Transaction Blog and subscribe for the latest news on the Engagement Bureau.

Tilaa tiedotteet sähköpostiisi

Haluatko tietää asioista ensimmäisten joukossa? Kun tilaat tiedotteemme, saat ne sähköpostiisi välittömästi julkaisuhetkellä. Tilauksen voit halutessasi perua milloin tahansa.

Lue lisää julkaisijalta Mastercard

Mastercardin syksyn Lighthouse FINITIV 2023 -kumppanuusohjelmaan viisi edistyksellistä finanssiteknologia-alan yritystä Suomesta7.9.2023 09:00:00 EEST | Tiedote

Mastercardin Lighthouse FINITIV -ohjelma on käynnistynyt 11. kerran. Syksyn ohjelmassa mukana on 15 poikkeuksellista finanssiteknologia-alan startup-yritystä Ruotsista, Suomesta ja Liettuasta. Ohjelma pyrkii kasvattamaan ja tukemaan jo ennestään aktiivista ja kasvavaa startup-yhteisöä näissä maissa. Tällä kertaa painopistealueita ovat esimerkiksi taloudellinen lukutaito, verkkokaupan maksut, lohkoketjumaksut, petosten estäminen ja henkilökohtainen taloudenhoito. Mastercardin ohjelma tukee innovaatioita ja kumppanuuksia sekä vertikaalisesti sijoittajien, pankkien ja muiden yrityskumppaneiden kanssa että horisontaalisesti ohjelmaan osallistuvien startupien ja varhaisvaiheen kasvuyritysten kesken. Mastercardin Lighthouse -ohjelman osallistujat syksyllä 2023: Suomi Starcart ratkaisee verkkokaupan ongelman siitä, miten ostaa tavaroita helposti ja halvalla. Se on kuin verkkokaupan Booking.com. Narvi Payments tarjoaa pankkitoimintaa palveluna keskikokoisille kasvuyrityksille. PayUp on mobiili

Mastercardin Lighthouse MASSIV -kumppanuusohjelmaan viisi teknologiayhtiötä Pohjoismaista ja Baltiasta7.9.2023 09:00:00 EEST | Tiedote

Mastercardin kumppanuusohjelma Lighthouse MASSIV pyrkii auttamaan miljardia ihmistä elämään nykyistä vauraampaa ja turvallisempaa elämää vuoteen 2025 mennessä. Syksyllä ohjelmassa on mukana viisi startup-yritystä, jotka keskittyvät kestävään kehitykseen ja sosiaaliseen vaikuttavuuteen. Suomesta mukana on Tespack. Toisin kuin muut yrityskiihdyttämöt Mastercard Lighthouse MASSIV on ilmainen. Sen painopiste on auttaa teknologiayrityksiä saavuttamaan YK:n kestävän kehityksen tavoitteensa kumppanuuksien avulla. Tuomalla pohjoismaiset ja baltialaiset startupit yhteen suurten organisaatioiden kanssa ohjelma auttaa vastuullisia innovaattoreita saavuttamaan maailmanlaajuisen peiton ratkaisuilleen. Mastercard Lighthouse MASSIV on kilpailuohjelma startup-yrityksille. MASSIVin vuoden 2023 syksyn ohjelmassa on mukana yrityksiä Suomen lisäksi Virosta, Norjasta ja Tanskasta. Mastercard Lighthouse MASSIVissa syksyllä mukana: Tespack – Suomalainen Tespack on älykkäiden mikroverkkojen edelläkävijä, joka

Mastercard ottaa käyttöön digitaalisten tilausten hallintaratkaisun29.6.2023 09:00:13 EEST | Tiedote

Mastercard tarjoaa Subaioin kanssa yksinkertaisen ja turvallisen tavan tunnistaa ja peruuttaa toistuvat maksut pankkien luotettavien sovellusten ja verkkopalveluiden kautta. Kuluttajat tekevät nykyään erilaisia verkkotilauksia enemmän kuin koskaan ennen, olipa kyse sitten ruuan tilaamisesta tai vaikkapa suoratoistopalveluista. Pelkästään Yhdysvalloissa kuluttajilla on keskimäärin 12 media- ja viihdetilausta, ja milleniaaleilla keskiarvo on 17. Tilaustalous kukoistaa, ja sen arvon odotetaan nousevan 1,5 biljoonaan dollariin vuoteen 2025 mennessä. Kasvu tarkoittaa, että kuluttajien on yhä haastavampaa seurata - tai peruuttaa - monia toistuvia maksujaan. Jotta kuluttajilla olisi paremmat mahdollisuudet peruuttaa ei-toivottujen palveluiden tilauksensa, on Mastercard on aloittanut yhteistyön Subaion kanssa. Subaio on Mastercardin Start Path – ohjelmassa palkittu startup. Sen ratkaisu antaa kuluttajille näkymän tilauksiinsa ja toistuviin maksuihinsa digitaalisessa pankkialustassaan riippumat

Finanssiteknologian startup Econans voitti Mastercardin Lighthouse FINITIV -kumppanuusohjelman18.11.2022 17:30:00 EET | Tiedote

Ruotsalainen finanssiteknologiayritys Econans on tämän syksyn Mastercard Lighthouse FINITIV 2022 -ohjelman voittaja. Lighthouse FINITIV on avoin innovaatio-ohjelma finanssiteknologia-alan kumppanuuksien kasvattamiseksi Pohjoismaissa ja Baltiassa. Suomen-sarjan voittaja on FinanceKey ja Baltian-sarjan KWOTA. Tanskalainen vihreän teknologian yhtiö Klimate sai sijoittajapalkinnon. Mastercardin tämän syksyn Lighthouse FINITIV -ohjelman voittajaksi nousi ruotsalainen Econans, joka tarjoaa digitaalisia ilmasto- ja taloudellisen vastuun simulaatio- ja automaattineuvontapalveluja. Seuraavaksi Econons pyrkii pääsemään liiketoimintaideallaan mukaan Mastercardin globaaliin Start Path -startup-ohjelmaan. Mastercardin FINITIV-ohjelma kestää kolme kuukautta ja antaa pohjoismaisille ja baltialaisille finanssiteknologian startupeille mahdollisuuden yhteistyöhön Mastercardin ja SEB:n, Danske Bankin, DNB:n, Swedbankin ja OP Ryhmän kaltaisten suurien pohjoismaisten pankkien kanssa. Joka kevät ja syksy oh

Tanskalainen sosiaalisen vaikuttamisen startup-yritys EcoTree voitti Mastercard Lighthouse MASSIV -kumppanuusohjelman18.11.2022 17:30:00 EET | Tiedote

Yksinkertaisia ja taloudellisesti kannattavia ratkaisuja puun tai metsän omistajaksi ryhtymiseen tarjoava EcoTree on valittu Lighthouse MASSIV 2022 -kumppanuusohjelman syksyn ohjelmavoittajaksi. Mastercardin kumppanuusohjelman tarkoituksena on löytää huomispäivän yksisarviset ja auttaa niitä skaalaamaan toimintaansa. EcoTree palkittiin tänään Lighthouse-palkinnonjakotilaisuudessa Slushissa. EcoTree saa nyt jatkuvaa tukea Mastercardilta ja pääsee pitchaamaan Mastercardin maailmanlaajuisessa Start Path -startup-ohjelmassa. Tanskalainen luontopohjaisten ratkaisujen toimittaja Ecotree tarjoaa yrityksille ja yksityishenkilöille yksinkertaisen tavan edesauttaa uudelleenmetsittämistä ja luonnonsuojelua. EcoTree valikoitui voittajaksi, koska se keskittyy sekä yksityishenkilöiden että yritysten sitouttamiseen ilmastonmuutoksen ratkaisemiseen ja luonnon monimuotoisuuden lisäämiseen. Sen toiminta on hieno yhdistelmä sosiaalista vaikuttamista ja kestävän kehityksen edistämistä. EcoTree osoitti myö

Mastercard

Mastercard