Stock of household deposits growing at a rapid pace

7.1.2020 13:00:00 EET | Suomen Pankki | Press release

Deposits with an agreed maturity and other deposits account for a lesser share of the total stock of household deposits. At the end of November 2019, deposits with an agreed maturity totalled EUR 4.8 bn and other deposits EUR 8.2 bn. The interest rate on the stock of deposits with an agreed maturity has no longer declined in 2019, standing at 0.51% in November. Credit institutions apply a higher interest rate on deposits of over 1 year (0.94% in November 2019) than on deposits with a shorter maturity (0.28% in November 2019). Deposits of over one year include e.g. ASP deposits – savings deposits for first home purchase – on which banks pay an interest of 1%. In November, households concluded EUR 235 million of new agreements on deposits with an agreed maturity, and the average interest rate on these was 0.15%.

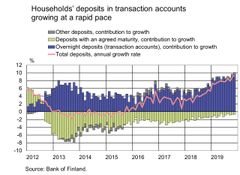

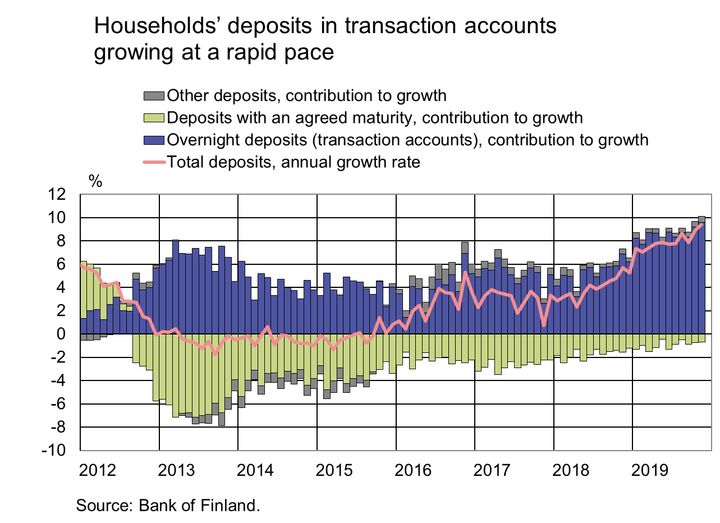

Growth in household deposits has picked up noticeably since the beginning of 2019. The acceleration started at the turn of the year, and in November household deposits already grew at an annual rate of 9.4%. The pick-up in the growth rate is particularly due to the high popularity of transaction accounts. The growth rate of funds in transaction accounts accelerated to 10% at the beginning of 2019 and was 11.3% in November. At the same time, the popularity of other deposits has increased slightly, and in November the annual growth rate of these deposits was 5.8%. The rapid contraction recorded in recent years in deposits with an agreed maturity slowed slightly, too. In November 2019, the stock of these deposits contracted at an annual rate of –11.2%. Growth rates of deposits can also be analysed now with the bank dashboard.

Loans

Households’ drawdowns of new housing loans in November 2019 amounted to EUR 1.7 bn, up by EUR 100 million on the corresponding period a year earlier. At the end of November, the stock of euro-denominated housing loans totalled EUR 100.3 bn and the annual growth rate of the stock was 2.7%. Household credit at end-November comprised EUR 16.5 bn in consumer credit and EUR 17.7 bn in other loans.

Drawdowns of new loans by non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.9 bn in November. The average interest rate on these declined from October, to 2.19%. At the end of November, the stock of euro-denominated loans to non-financial corporations totalled EUR 91.2 bn, of which loans to housing corporations accounted for EUR 34.7 bn.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Keywords

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Eurosystemets penningpolitiska beslut5.2.2026 15:23:03 EET | Pressmeddelande

ECB-rådet beslutar om penningpolitiken i euroområdet. ECB-rådet beslutade idag att hålla de tre styrräntorna oförändrade.

EKP:n rahapoliittisia päätöksiä5.2.2026 15:23:03 EET | Tiedote

EKP:n neuvosto päättää euroalueen rahapolitiikasta.8 EKP:n neuvosto päätti tänään pitää EKP:n kolme ohjauskorkoa ennallaan.

I december 2025 hade hushållen nästan lika mycket banklån som ett år tidigare30.1.2026 10:00:00 EET | Pressmeddelande

Beloppet av de finländska hushållens sammanlagda utestående banklån var nästan oförändrat från året innan och uppgick till 140,9 miljarder euro i december 2025. Det förekommer emellertid skillnader i utvecklingen av utbetalningarna av lån för olika ändamål.

Kotitalouksilla oli joulukuussa 2025 pankkilainaa lähes saman verran kuin vuosi sitten30.1.2026 10:00:00 EET | Tiedote

Suomalaisten kotitalouksien yhteenlaskettu pankkilainakanta pysyi lähes muuttumattomana vuodentakaisesta; se oli 140,9 mrd. euroa joulukuussa 2025. Eri käyttötarkoituksiin otettujen lainamäärien kehityksessä on kuitenkin eroja.

Household bank loans almost unchanged year-on-year in December 202530.1.2026 10:00:00 EET | Press release

Finnish households’ aggregate stock of bank loans remained almost unchanged from a year earlier, at EUR 140.9 billion in December 2025. However, developments in loan volumes by different purposes vary.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom